As of now, the world is on its fast track, saving money is really crucial. It’s been noticed that after an increase in salary, even at a large scale savings are not possible. After getting a monthly salary, lots of spending plans around us. Many things in our mind to use salary, like expenses, investments, savings, etc. In anyhow, planning for each bug earned is to be a must, else nobody can save at all.

We can see some ratio of expenses, investments, etc while using the money of salary. The only part to remember is from where we can extract part of saving. In place of spending more on existing expenditures, cut out the ratio & save money. Without any planning, salaried people can never save, which means even a single bug for the future due to the continued habit of spending money for existing & new endeavors.

Come on, let’s take a tour to understand planning pointers to save money:

Smart Daily Spendings:

Daily spending always takes enough part of the salary. Let’s discuss necessities & avoidable expenses. Of course, once we are on wheels in daily life, it’s a time to bifurcate spending in different categories as we used to be habitual of all. The conclusion is to fix the expenses in criteria to live life or can say make a boundary to not increase & cut some part as savings, such as Food, subscriptions, mobile recharges, electricity charges, transportation, etc.

Investments

Due to the fast lifestyle culture, saving from salary is not enough nowadays. Planning for saving through several kinds of investments works in this matter. Better growth can be planned via smart investments, like PPF/EPF, Corporate bonds, Mutual Funds & so on. A smart investment plan results in good returns which can be a better source of savings. Here, one can remember to avoid impatience & unlimited money spent/invested that can be harmful to overall wealth. Investing in multiple sources is also a good option to get an experienced track on financial flow.

Avoid Bad Habits

Bad habits is in trend among young group culture, like alcohol, smoking, etc. that can be a cause of big loss in salary and same will result in health issues, ultimately consume almost overall salary sometimes. Avoiding such habits can help in salary/money-saving along with keeping a healthy life. And of course, a healthy lifestyle boost earning capabilities & smart decisions.

Online Shopping Techniques

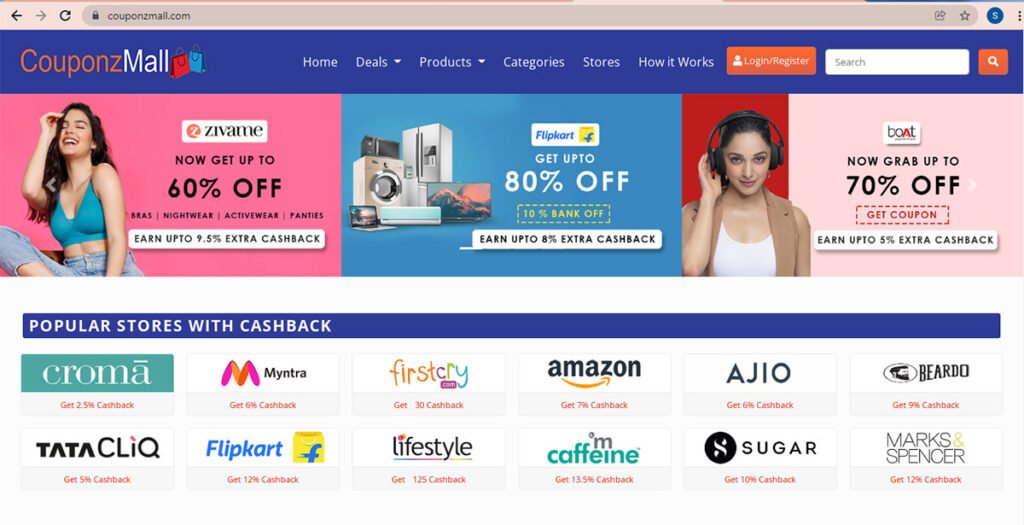

For daily livelihood, spending money is quite common via online shopping. In India, buying through an online shopping store is common. Whether it’s about fashion, grocery, subscriptions, bill payments & more. People always look for saving money with different offers, deals & discounts, for this even subscribing on several platforms is also common. With the current online shopping culture, we can see multiple cashback websites, not in India but globally too. In this era, where savings are critical, Couponzmallis a perfect platform, where a consumer can save not only with ongoing offers but also cashback on every purchase in every category for a lifetime. Smart shopping on this can save a lot as 1000+ online shopping platforms are available, which helps in saving via cashback on all categories. How it helps:

- You get signup bonus cashback

- 2. You get all current offers, coupons, discounts & deals at single place

- 3. You can check the best price through the Price comparison tool across various online shopping stores on Couponzmall

- 4. And the best thing, every time you buy through browsing on Couponzmall, you’ll get a cashback every time.

- 5. Not only this, but you can also refer a friend & get cashback on Friend

- 6. You can withdraw cashback from Couponzmall Wallet to any of your preferred modes like Bank Account, PayTM, Gpay, or Amazon Pay.

Avoid Borrowings

The concept of investing in the smartest way can help to avoid borrowings in needy time. Borrowings/Loans always come with interest which is totally an avoidable expenditure. Take help in investment returns rather than taking loans with a high-interest rate. Paying money additional on the actual amount borrowed is a huge cut of a salaried person.

Saving on Basic needs

Suggestions under “Online shopping techniques” can also help in saving on basic needs. If talking about food & beverages, dining costs can be controlled by cooking in-house or ordering online with different offers & cashback schemes through websites like Couponzmall. It can save money on per head dining outside with transportation costs too. It’s a good option to save money with save time. Ultimately, fewer visits for dining outside increases saving salary money as more as adopting habit frequently.

Conclusion

Discussion about multiple parameters of saving money with an article focused on common understanding spread around earners. Review of smart spending with saving option can help in salary saving of earners. Now smart spending is about cutting spending or using cashback websites to get maximum offers. No doubt, avoiding alcohol, smoking habits has a great impact on saving & health too. Also, as detailed in the article, borrowings are common nowadays, can be skipped by encouraging strategic investments with good returns.